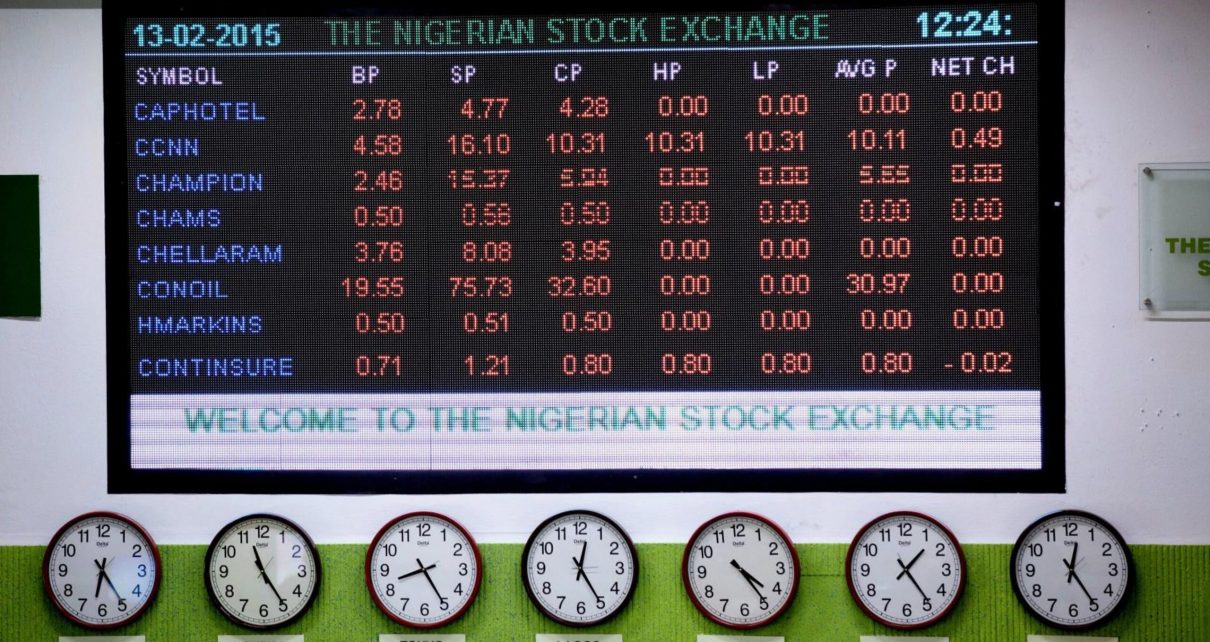

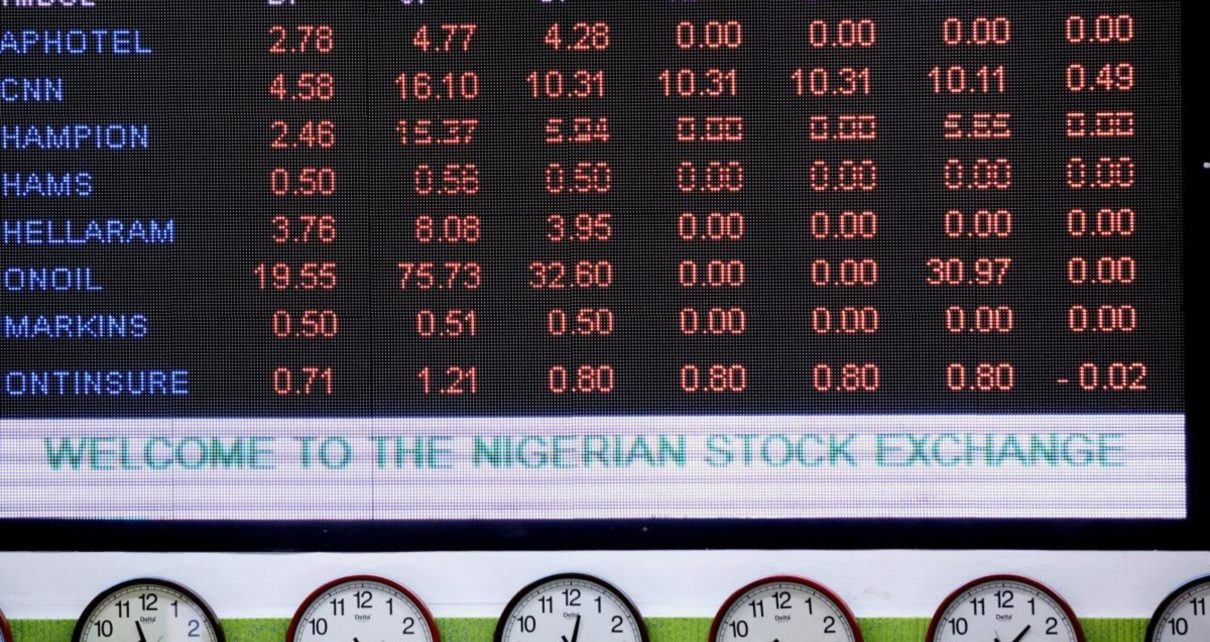

The Nigerian Stock Exchange (NSE) recorded marginal growth on Tuesday, appreciating by 0.02 per cent on renewed bargain hunting to halt downward posture of four consecutive trading sessions. Specifically, the All-Share Index increased by 6.55 points or 0.02 per cent to close at 28,344.04 compared with 28,337.49 posted on Monday. Similarly, the market capitalisation which Read More…

Stocks

NSE opens week with 0.27% loss

The nation’s bourse opened trading on Monday on a negative trend with the market indicators declining by 0.27 per cent, amid sell pressure in 16 stocks. Specifically, the All-Share Index dipped 77.82 points or 0.27 per cent to close at 28,337.49 from 28,415.31 achieved on Friday. Also, the market capitalisation which opened at N14.852 trillion Read More…

Nigeria stock market drops further by N68bn

The bears maintained dominance on the Nigerian Stock Exchange on Friday with the market capitalisation declining further by N68 billion. Specifically, the market capitalisation dropped N68 billion or 0.46 per cent to close at N14.852 against N14.920 trillion. Also, All-Share Index which opened at 28,546.22 lost 130.91 points or 0.46 per cent to close at Read More…

NSE halts bullish trend, indices down 0.95%

The Nigerian Stock Exchange market indices on Wednesday dropped by 0.95 per cent after 12 consecutive days of bullish trading. The drop followed profit taking in blue chips. Speficially, the All-Share Index dipped 275.02 points or 0.95 per cent to close at 28,634.35 compared with 28,909.37 recorded on Tuesday. Also, the market capitalisation lost N144 Read More…

Nigeria stock market rises by N297bn, amid Airtel, Seplat gain

The nation’s bourse opened trading on Monday with a growth of N297 billion following gains by some highly capitalised stocks. Specifically, the market capitalisation inched higher by N297 billion or 2.11 per cent to close at N14.402 trillion from N14.105 trillion recorded on Friday. Similarly, the All-Share Index increased by 568.72 points or 2.11 per Read More…

Nigeria stock market opens October with N80bn gain

The nation’s bourse resumed trading for the month of October on a positive trend, amid gains recorded by Dangote Cement and MTN Nigeria Communications. Speficially, the All-Share Index on Friday rose by 172.01 points or 0.64 per cent to close at 26,985.77 compared with 26,813.76 achieved on Wednesday. Also, the market capitalisation inched higher by Read More…

NSE market capitalisation ends September bullish, crosses N14trn mark

The Nigerian Stock Exchange (NSE) market capitalisation crossed N14 trillion mark on the last trading day of September due to sustained confidence. Speficially, the market capitalisation on Wednesday rose by N118 billion or 0.84 per cent to close at N14.025 trillion against N13.907 trillion achieved on Tuesday. The increase in the market capitalisation was as Read More…

Trading remains upbeat on NSE, index up 1.28%

Activities on the Nigerian Stock Exchange on Friday remained upbeat for the fifth consecutive day, with the All-Share Index growing by 1.28 per cent to cross 26,000 mark. The index rose by 332.20 points or 1.28 per cent to close at 26,319.34, compared with 25,987.14 recorded on Thursday. In the same vein, the market capitalisation Read More…

NSE market capitalisation gains N107bn Thursday

The bulls continued to dominate trading on the nation’s bourse with the market capitalisation appreciating further by N107 billion on Thursday, amid gains by blue chips. Specifically, the market capitalisation inched higher by N107 billion or 0.79 per cent to close at N13.581 trillion from N13.474 trillion achieved on Wednesday. Also, the All-Share Index grew Read More…

NSE market capitalisation sustains growth by N67bn

The Nigerian Stock Exchange (NSE) key market indicators on Wednesday sustained positive rally, appreciating by 0.50 per cent due to monetary policy rate cut to 11.5 per cent. Speficially, the market capitalisation rose by N67 billion to close at N13.474 trillion against N13.407 trillion recorded on Tuesday. Also, the NSE All-Share Index inched higher by Read More…