Transactions on the Nigerian Stock Exchange on Tuesday rebounded further by 0.31 per cent, just as the Monetary Policy Committee (MPC) reduced interest rate by 100 basis points.

The MPC of the Central Bank of Nigeria (CBN) at the end of two-day meeting slashed monetary policy rate by 100 basis points to 11.5 per cent from 12.5 per cent.

Mr Godwin Emefiele, the CBN Governor, said the committee retained the cash reserve ratio at 27.5 per cent due to inflationary pressures driven by structural policies.

Speficially, the market capitalisation rose by N42 billion or 0.31 per cent to close at N13.407 trillion against N13.365 trillion achieved on Monday.

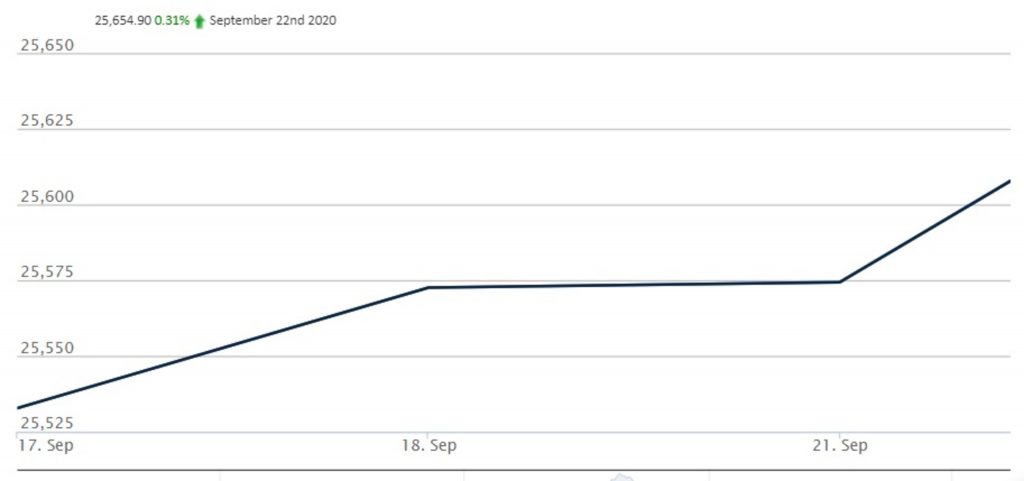

Also, the All-Share Index which opened at 25,574.35 inched higher by 80.55 points to close at 25,654.90 following gains posted by MTN Nigeria and eight other equities.

Accordingly, the month-to-date gain increased to 1.3 per cent while the year-to-date loss moderated to -4.4 per cent.

Mr Ambrose Omordion, the Chief Operating Officer, InvestData Ltd,. attributed the rally to the outcome of the MPC meeting.

Omordion who commended the interest rate cut expressed optimism that there would be movement of funds from money market into the stock market due to higher return.

The upturn was impacted by gains recorded in large and medium capitalised stocks, amongst which are; MTNN, Red Star Express, FBN Holdings, Dangote Sugar Refinery and Trans-Nationwide Express.

Analysts at Afrinvest Limited expected bargain hunting to persist in the market.

Red Star Express led the gainers’ chart in percentage terms, gaining 9.80 per cent to close at N3.25 per share.

Consolidated Hallmark Insurance followed with 9.68 per cent to close at 34k, while Trans-Nationwide Express rose by 9.33 per cent to close at 82k per share.

Lasaco Assurance rose by four per cent to close at 26k, while MTNN appreciated by 2.41 per cent to close at N123 per share.

Conversely, Union Bank of Nigeria topped the losers’ chart in percentage terms, dropping 6.54 per cent to close at N5 per cent.

Cornerstone Insurance trailed with 6.25 per cent to close at 60k, while Linkage Assurance lost five per cent to close at 38k per share.

Mutual Benefits Assurance, Chams and Courteville Business Solutions shed 4.76 per cent each to close at 20k per share each.

In the same vein, the volume of shares traded rose by 33.62 per cent with 262.05 million shares worth N4.39 billion achieved in 3,254 deals.

This was in contrast with 196.12 million shares valued at N1.73 billion exchanged in 3,542 deals on Monday.

Transactions in the shares of Zenith Bank topped the activity chart with 45.88 million shares worth N766.27 million.

FBN Holdings accounted for 24.14 million shares valued at N119.50 million, while Transcorp sold 20.97 million shares worth N12.55 million.

FCMB Group traded 20.53 million shares valued at N42.28 million, while Guaranty Trust Bank transacted 20.33 million shares worth N516.43 million. (NAN)