The Nigerian Stock Exchange (NSE) on Wednesday reacted to social unrest following the aftermath of #EndSARS protests losing N113 billion, amid sell pressure.

Specifically, the market capitalisation shed N113 billion or 0.75 per cent to close at N14.870 trillion against N14.983 trillion recorded on Tuesday.

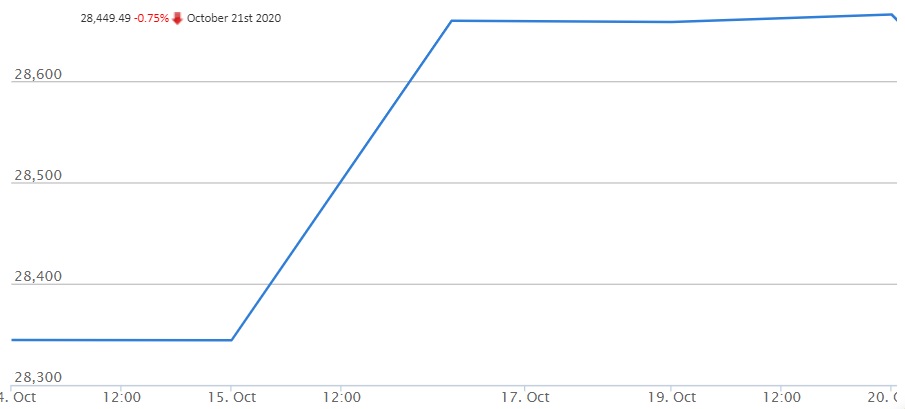

Also, the All-Share Index dipped 216.33 points or 0.75 per cent to close at 28,449.49 compared with 28,665.82 achieved on Tuesday.

Consequently, the month-to-date and year-to-date gains both moderated to 6.0 per share.

Mr Ambrose Omordion, the Chief Operating Officer, InvestData Ltd., attributed the loss to panic selloff by investors in reactions to the shooting of protesters and disruptions of economic activities.

Omordion said that the development had worsened the nation’s political and economic risk that would further delay economic recovery.

“The state of the nation at this point will affect local and international investors confidence in the market and the economy in general,” he said.

The downtrend was impacted by losses recorded in large and medium capitalised stocks, among which are; MTN Nigeria Communications, Guinness, Lafarge Africa, Ardova and Julius Berger.

Market sentiment was negative with 34 losers in contrast with four gainers.

On the other hand, Royal Exchange led the losers’ chart in percentage terms by eight per cent to close at 23 kobo per share.

Neimeth International Pharmaceuticals followed with 7.57 per cent to close at N1.71, while Union Diagnostic and Clinical Services shed 7.41 per cent to close at 25k per share.

Lasaco Assurance dipped 7.14 per cent to close at 26k, while United Capital shed 7.03 per cent to close at N3.57 per share.

Conversely, Wapic Insurance topped the gainers’ chart, gaining 10 per cent to close at 44k per share.

Portland Paints and Products followed with 2.50 per cent to close at N2.05, while UACN Property garnered 1.23 per cent to close at 82 per share.,

Nigerian Breweries appreciated by 0.97 per cent to close at N52 per share.

However, the total volume of shares traded rose by 9.84 per cent to 326.58 million shares worth N4.23 billion traded in 4,367 deals.

This was in contrast with a total of 296.31 million shares valued at N2.93 billion exchanged in 4,736 deals on Tuesday.

Transactions in the shares of United Bank for Africa topped the activity chart with 40.29 million shares worth N272.15 million.

Zenith Bank followed with 39.61 million shares valued at N800.94 million, while Guaranty Trust Bank traded 38.19 million shares worth N1.14 million.

Transcorp accounted for 31.18 million shares valued at N18.72 million, while FBN Holdings sold 29.97 million shares worth N181.01 million. (NAN)