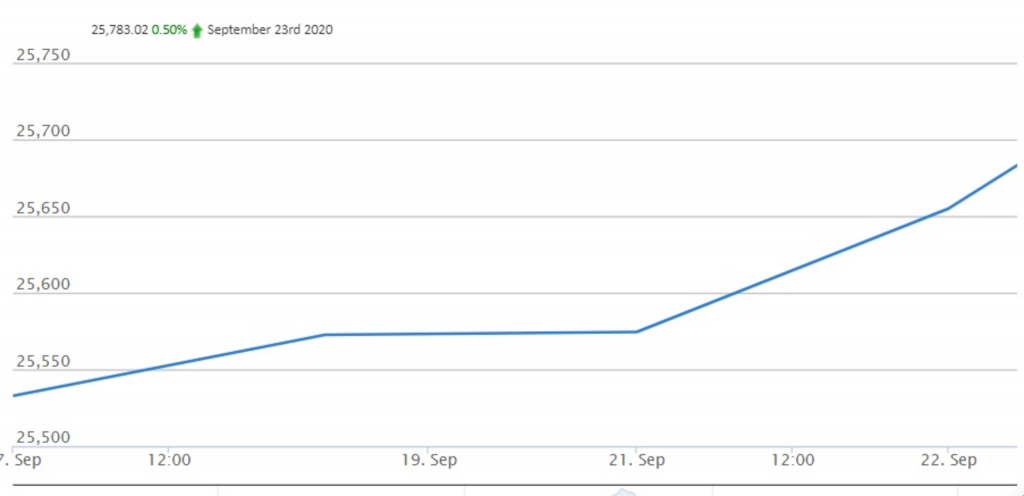

The Nigerian Stock Exchange (NSE) key market indicators on Wednesday sustained positive rally, appreciating by 0.50 per cent due to monetary policy rate cut to 11.5 per cent.

Speficially, the market capitalisation rose by N67 billion to close at N13.474 trillion against N13.407 trillion recorded on Tuesday.

Also, the NSE All-Share Index inched higher by 128.12 points or 0.50 per cent to close at 25,783.02 from 25,654.90 achieved on Tuesday.

The performance was supported by bargain buying in MTN Nigeria Communications, Nigerian Breweries, Seplat, Mobil and Flour Mills.

Consequently, the month-to-date gain increased to 1.8 per cent while the year-to-date loss moderated to -4.0 per cent.

Analysts at Cordros Capital Ltd had predicted that the fixed income market would see a downward adjustment in yields, thereby making the equities market more attractive.

Market sentiment closed positive with 21 gainers in contrast with 14 losers.

International Breweries and Prestige Assurance dominated the gainers’ chart in percentage terms, rising by 10 per cent each to close at N3.60 and 60k per share, respectively.

UACN Property grew by 5.26 per cent to close at N1, while Seplat appreciated by 3.90 per cent to close at N400 per share.

Conversely, Associated Bus Company led the laggards’ chart in percentage terms, dropping 9.09 per cent to close at 30k per share.

Royal Exchange trailed with a loss of 6.90 per cent to close at 27k, while Eterna lost 6.72 per cent to close at N2.50 per share.

NPF Micro Finance Bank shed 6.15 per cent to close at N1.22, while AIICO Insurance depreciated by 3.37 per cent to close at 86k per share.

Transactions in the shares of Sterling Bank topped the activity chart with 85.21 million shares valued at N97.99 million.

FBN Holdings sold 82.74 million shares worth N413.70 million, while Access Bank exchanged 58.21 million shares valued at N366.71 million.

Zenith Bank traded 28.45 million shares worth N480.21 million, while MTNN accounted for 25.72 million shares valued at N3.13 billion.

In all, the volume of shares traded increased by 58.05 per cent as investors bought and sold 414.16 million shares worth N6.28 billion in 3,793 deals.

This was in contrast with 262.05 million shares valued at N4.39 billion achieved in 3,254 deals on Tuesday. (NAN)