By Joy Mfon Essien, Contributing Editor

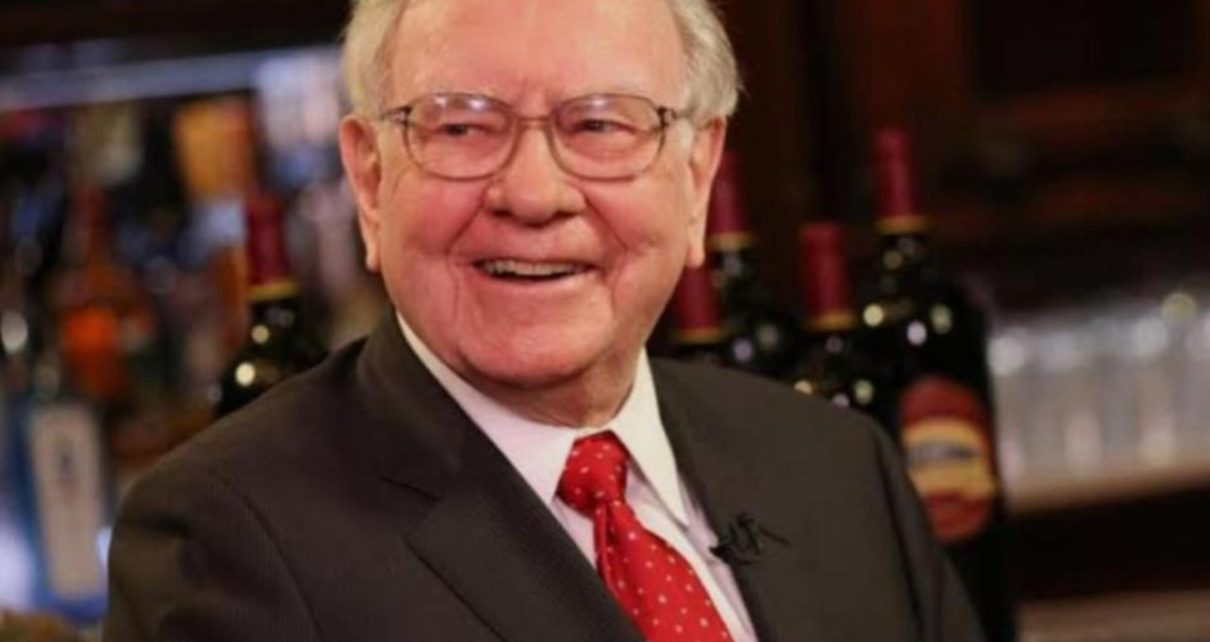

At age 95, legendary investor Warren Buffett stepped down on Wednesday, December 31, as CEO of Berkshire Hathaway after 55 years of building the once failing textile business into one of the world’s largest and most powerful companies and one of the most successful asset managers in the world.

Buffett who is often referred to as the “Oracle of Omaha” and the “billionaire next door,” will relinquish the title to

Greg Abel, the 63-year-old lesser-known CEO of Berkshire’s energy business while he, Buffett, will remain its chairman.

His strategy of using insurance premiums, “float,” to make brilliant investments in stocks and to help buy entire companies transformed the struggling textile mill into a $1 trillion conglomerate and made him one of the wealthiest people in the world with a net worth of more than $150 billion.

It all started in 1942, when Buffett, not yet 12 years old, bought $114.75 worth of stock in natural gas company Cities Service. Buffett had saved for the purchase since the age of 6. “I had become a capitalist, and it felt good,” Buffett wrote in the 2018 edition of his famed annual shareholder letter.

By the time he was 16, his investment grew to the equivalent of about $53,000. He was a millionaire at 32 and a billionaire at 56. Buffett is now the 10th richest person in the world, according to Bloomberg Billionaires, with a fortune of $150 billion.

Buffet redefined investing for the American public with his practical philosophies of only investing in what you know, and that the stock market is tough to beat

Since he started to use Berkshire Hathaway as his primary investment vehicle in 1964, the company’s share price has risen more than 5,500,000%.

Berkshire ranks as the 11th most valuable company in the world with a market value of over $1 trillion.

With investments in industries ranging from railroads and insurance to candy and ice cream, Berkshire’s major enterprises include the BNSF railroad, insurer Geico and well-known brands such as See’s Candy, Benjamin Moore, Duracell, Fruit of the Loom, Oriental Trading, Dairy Queen and Helzberg Diamonds.

The rest of Berkshire’s portfolio includes household names, several close to Buffett’s heart. Berkshire’s third largest holding, valued at about $28 billion, is The Coca-Cola Company. Buffett is a renowned heavy Coke drinker. Other firms that make up more than 70% of Berkshire’s investments include American Express, Bank of America and oil major Chevron.

Apple has ranked consistently as Berkshire’s top investment holding. As of Berkshire’s most recent filings, Apple shares represent more than 20% of the firm’s portfolio with a stake valued at more than $65 billion.

Buffett’s philanthropy, on the other hand, may turn out to be the most enduring part of his legacy.

In 2010, Buffett launched “The Giving Pledge” with fellow billionaires Melina French Gates and Microsoft founder Bill Gates. Buffett pledged to give away all of his wealth gradually to philanthropic causes, including the Gates Foundation. Since 2010, more than 250 other wealthy people have also signed on.

In June, Buffett announced his latest philanthropic donations, bringing his total benefactions to more than $60 billion.

Speaking on NBC’s “TODAY” in 2013, Buffett said “money does me no good at all, has no utility to me.”

But “it can have enormous utility to people around the world,” he said.