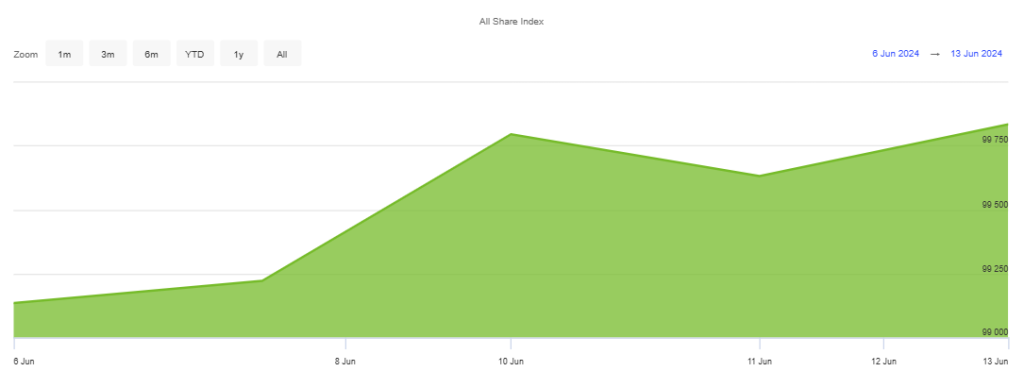

The Nigerian stock market demonstrated resilience and moderate growth as the All-Share Index (ASI) inched up by 0.20%, closing at 99,832.25. This increment, though modest, reflects a positive sentiment among investors as they navigate the diverse landscape of listed equities on the Nigerian Exchange, including those on the Growth Board.

The day saw a substantial number of deals, totalling 9,686, indicating high market activity and investor participation. The trading volume reached an impressive 502,599,278 shares, translating into a total market value of N8,653,032,209.43. This reflects the vibrant trading environment and the significant monetary flow within the exchange.

The equity market capitalisation stood robustly at N 56,473,975,607,254.27, showcasing the vast scale of the equity market on the Nigerian Exchange. Meanwhile, the bond market maintained a solid capitalization of N46,476,296,409,970.7, indicating strong investor confidence in debt instruments. Additionally, the market capitalization for Exchange Traded Funds (ETFs) was recorded at N 29,554,892,879.52, reflecting the steady interest in diversified investment products.

Equities Market

Top Advancers: The equities market saw notable gains with Nigerian Breweries (NB) leading the pack. NB’s stock surged by 10.00%, closing at N 31.90 from a previous close of N 29.00. This substantial increase can be attributed to strong investor confidence and positive market sentiments.

Unity Bank (UNITYBNK) followed closely, appreciating by 9.91% to close at N 1.22, up from N1.11. NEM Insurance (NEM) also enjoyed significant gains, climbing 9.77% to close at N 9.55. Thomas Wyatt Nigeria (THOMASWY) saw a 9.43% increase, closing at N 1.74, while UAC of Nigeria (UACN) rounded out the top five advancers with an 8.65% rise, closing at N 14.45.

Top Decliners: On the other end of the spectrum, Ecobank Transnational Incorporated (ETI) experienced the most significant decline, dropping by 9.92% to close at N 21.35. DAAR Communications (DAARCOMM) saw an 8.77% decrease, closing at N 0.52. C&I Leasing (CILEASING) fell by 7.14% to N 2.60. RT Briscoe (RTBRISCOE) and Custodian Investment (CUSTODIAN) both declined by 5.08%, closing at N 0.56 and N9.35 respectively.

Trading Volume and Value

The market was buoyant with active trading, particularly in the banking sector. Zenith Bank (ZENITHBANK) led the trading volume with 71,220,970 shares traded, valued at N2,520,817,450.35. AIICO Insurance (AIICO) followed with 67,300,382 shares, albeit at a lower total value of N65,943,492.63. Access Holdings (ACCESSCORP) saw 58,526,498 shares traded, amounting to N1,125,223,030.60. Guaranty Trust Holding Company (GTCO) recorded 46,857,553 shares traded at N1,964,168,937.55, while United Bank for Africa (UBA) traded 23,169,778 shares, valued at N520,570,205.30.

Bonds Market

The bonds market showed stability with no declines recorded. The FGSUK2033S6 bond saw a slight increase, closing at N100.00 from a previous close of N98.00. Other bonds such as FMN2025S3B, TSL2030S1, BAU2021S1, and CSF2025S1 remained steady, all closing at N 100.00.

ETFs Performance

In the Exchange Traded Funds (ETFs) segment, the SIAMLETF40 experienced a significant gain, rising by N 101.00 to close at N 1111.00. The STANBICETF30 also saw an increase of N 62.99, closing at N 693.00. The LOTUSHAL15 and VETBANK ETFs recorded modest gains, closing at N30.00 and N8.15, respectively. The VETINDETF remained unchanged, closing at N47.10.

In general, the overall market performance indicates a balanced yet cautiously optimistic sentiment among investors. The moderate increase in the ASI, coupled with significant trading volumes and values, highlights a robust engagement in the market. Investors are encouraged to stay informed and consider both the opportunities and risks presented by the current market dynamics.

Market Overview Snapshot

All-Share Index (ASI): 99,832.25 (+0.20%)

Market Activities:

- Number of Deals: 9,686

- Volume Traded: 502,599,278 shares

- Value of Trades: N 8,653,032,209.43

- Equity Market Capitalisation: N 56,473,975,607,254.27

- Bond Market Capitalisation: N 46,476,296,409,970.7

- ETF Market Capitalisation: N 29,554,892,879.52

Equities Performance

Top 5 Advancers:

| Symbol | Last Close | Current | Change | % Change |

|---|---|---|---|---|

| NB | N 29.00 | N 31.90 | 2.90 | 10.00% |

| UNITYBNK | N 1.11 | N 1.22 | 0.11 | 9.91% |

| NEM | N 8.70 | N 9.55 | 0.85 | 9.77% |

| THOMASWY | N 1.59 | N 1.74 | 0.15 | 9.43% |

| UACN | N 13.30 | N 14.45 | 1.15 | 8.65% |

Top 5 Decliners:

| Symbol | Last Close | Current | Change | % Change |

|---|---|---|---|---|

| ETI | N 23.70 | N 21.35 | -2.35 | -9.92% |

| DAARCOMM | N 0.57 | N 0.52 | -0.05 | -8.77% |

| CILEASING | N 2.80 | N 2.60 | -0.20 | -7.14% |

| RTBRISCOE | N 0.59 | N 0.56 | -0.03 | -5.08% |

| CUSTODIAN | N 9.85 | N 9.35 | -0.50 | -5.08% |

Top 5 Trades by Volume

| Symbol | Volume | Value (N) |

|---|---|---|

| ZENITHBANK | 71,220,970 | 2,520,817,450.35 |

| AIICO | 67,300,382 | 65,943,492.63 |

| ACCESSCORP | 58,526,498 | 1,125,223,030.60 |

| GTCO | 46,857,553 | 1,964,168,937.55 |

| UBA | 23,169,778 | 520,570,205.30 |

Bonds Market Performance

| Symbol | Last Close | Current | Change | Volume |

|---|---|---|---|---|

| FGSUK2033S6 | N 98.00 | N 100.00 | 2.00 | – |

| FMN2025S3B | N 100.00 | N 100.00 | 0.00 | – |

| TSL2030S1 | N 100.00 | N 100.00 | 0.00 | – |

| BAU2021S1 | N 100.00 | N 100.00 | 0.00 | – |

| CSF2025S1 | N 100.00 | N 100.00 | 0.00 | – |

ETFs Performance

| Symbol | Last Close | Current | Change | Volume |

|---|---|---|---|---|

| SIAMLETF40 | N 1010.00 | N 1111.00 | 101.00 | – |

| STANBICETF30 | N 630.01 | N 693.00 | 62.99 | – |

| LOTUSHAL15 | N 29.70 | N 30.00 | 0.30 | – |

| VETBANK | N 7.90 | N 8.15 | 0.25 | – |

| VETINDETF | N 47.10 | N 47.10 | 0.00 | – |