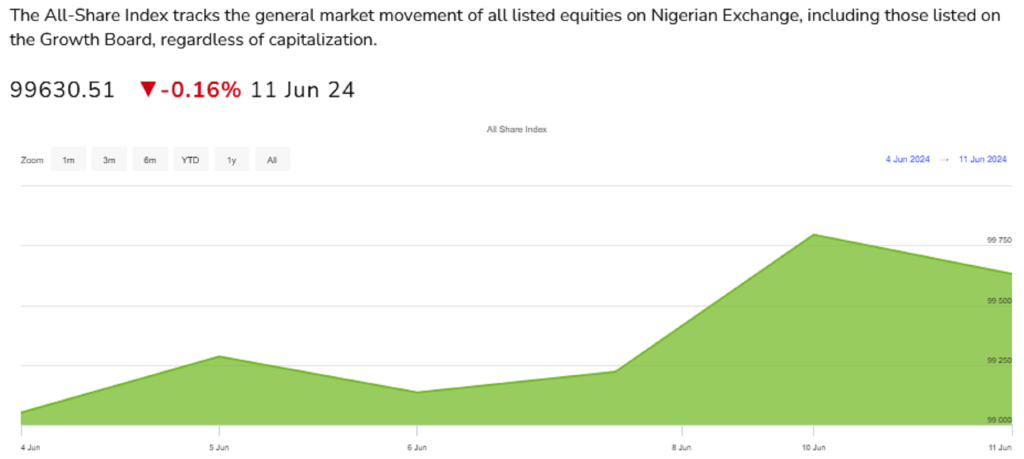

On June 11, 2024, the Nigerian Exchange’s All-Share Index (ASI) experienced a modest decline. The ASI, which monitors the overall market movement of all listed equities, including those on the Growth Board, closed at 99,630.51 points. This represents a slight decrease of 0.16% from the previous trading day. This dip indicates a cautious approach among investors, potentially influenced by prevailing economic conditions and global market trends.

The day’s trading activity was notably vigorous, underscored by substantial volumes and values. A total of 8,064 deals were executed, with the volume of shares traded reaching 848,965,335. The total value of these trades amounted to N16,551,035,805.29. The equity market capitalisation stood at N56,359,857,702,142.29, while the bond market capitalisation was N46,514,638,376,258.20. Notably, the ETF market capitalisation remained at zero, indicating no trading activity in this segment.

In the equities market, several stocks showed significant gains. TOTAL led the top gainers with a considerable increase from its previous closing price of N 353.60 to N 388.90, marking a rise of N 35.30 or 9.98%. This surge in TOTAL’s stock price could be attributed to positive corporate news or favourable market conditions impacting the company.

PRESCO also demonstrated strong performance, closing at N 323.20, up from N 293.90. This represents an increase of N 29.30 or 9.97%. The stock’s robust performance may reflect investor confidence in its growth prospects or recent operational successes.

Other notable gainers included UPDC, which saw its stock price rise by N 0.12 or 9.92%, closing at N 1.33 from the previous N 1.21. FTNCOCOA followed with a 9.65% increase, moving from N 1.14 to N 1.25, while CHAMS rounded out the top five gainers with a 9.47% increase, closing at N 1.85 from N 1.69.

The bond market exhibited stability with minimal price fluctuations, except for FGS202514, which saw a notable increase. The price of FGS202514 rose from N 70.00 to N 100.00, an impressive gain of N 30.00. This significant movement may be driven by increased demand for this particular bond, possibly as investors seek safer investments amidst market uncertainty.

Other bonds, including FGS202520, FGS202537, FGS202638, and FGS202648, maintained their previous closing prices. This stability suggests a predictable bond market environment, which can be reassuring for investors looking for steady returns.

The ETF market remained unchanged for the day, with no variations in prices or trading volumes. Key ETFs such as VETINDETF, NEWGOLD, LOTUSHAL15, VSPBONDETF, and VETBANK all maintained their previous closing prices. This lack of movement indicates a day of low activity in the ETF segment, possibly due to investors holding their positions or waiting for clearer market signals.

The performance of the Nigerian Exchange on June 11, 2024, paints a picture of mixed market sentiment. The slight decline in the All-Share Index reflects a degree of caution among investors. However, the significant gains in certain equities, such as TOTAL and PRESCO, indicate pockets of optimism and confidence in specific sectors or companies.

The bond market’s overall stability, with a notable rise in FGS202514, suggests that while some investors are looking for steady, low-risk returns, others are willing to capitalise on perceived opportunities. Meanwhile, the ETF market’s stagnation hints at a wait-and-see approach from investors in this segment.

Equities

Top 5 Advancers

| Symbol | Last Close (N) | Current (N) | Change (N) | % Change |

|---|---|---|---|---|

| TOTAL | 353.60 | 388.90 | 35.30 | 9.98% |

| PRESCO | 293.90 | 323.20 | 29.30 | 9.97% |

| UPDC | 1.21 | 1.33 | 0.12 | 9.92% |

| FTNCOCOA | 1.14 | 1.25 | 0.11 | 9.65% |

| CHAMS | 1.69 | 1.85 | 0.16 | 9.47% |

TOTAL led the top gainers’ chart with a notable increase of N 35.30 or 9.98%, closing at N 388.90. PRESCO followed closely with a N 29.30 gain, representing a 9.97% increase to close at N 323.20.

Bonds

Top Movers

| Symbol | Last Close (N) | Current (N) | Change (N) | Volume |

|---|---|---|---|---|

| FGS202514 | 70.00 | 100.00 | 30.00 | – |

| FGS202520 | 99.99 | 99.99 | 0.00 | – |

| FGS202537 | 100.00 | 100.00 | 0.00 | – |

| FGS202638 | 100.00 | 100.00 | 0.00 | – |

| FGS202648 | 80.00 | 80.00 | 0.00 | – |

The bond market witnessed significant movement in FGS202514, which saw a N 30.00 increase, closing at N 100.00. Other bonds remained stable.

Exchange Traded Funds (ETFs)

Summary

| Symbol | Last Close (N) | Current (N) | Change (N) | Volume |

|---|---|---|---|---|

| VETINDETF | 47.10 | 47.10 | 0.00 | – |

| NEWGOLD | 22,750.01 | 22,750.01 | 0.00 | – |

| LOTUSHAL15 | 29.70 | 29.70 | 0.00 | – |

| VSPBONDETF | 284.99 | 284.99 | 0.00 | – |

| VETBANK | 7.90 | 7.90 | 0.00 | – |

ETF prices remained unchanged across the board, with no recorded changes in price or volume.

All-Share Index Performance

Market Activity Summary

| Category | Value |

|---|---|

| All-Share Index (ASI) | 99,630.51 |

| Deals | 8,064 |

| Volume | 848,965,335 |

| Value | N 16,551,035,805.29 |

| Equity Capitalization | N 56,359,857,702,142.29 |

| Bond Capitalization | N 46,514,638,376,258.20 |

| ETF Capitalization | N 0 |