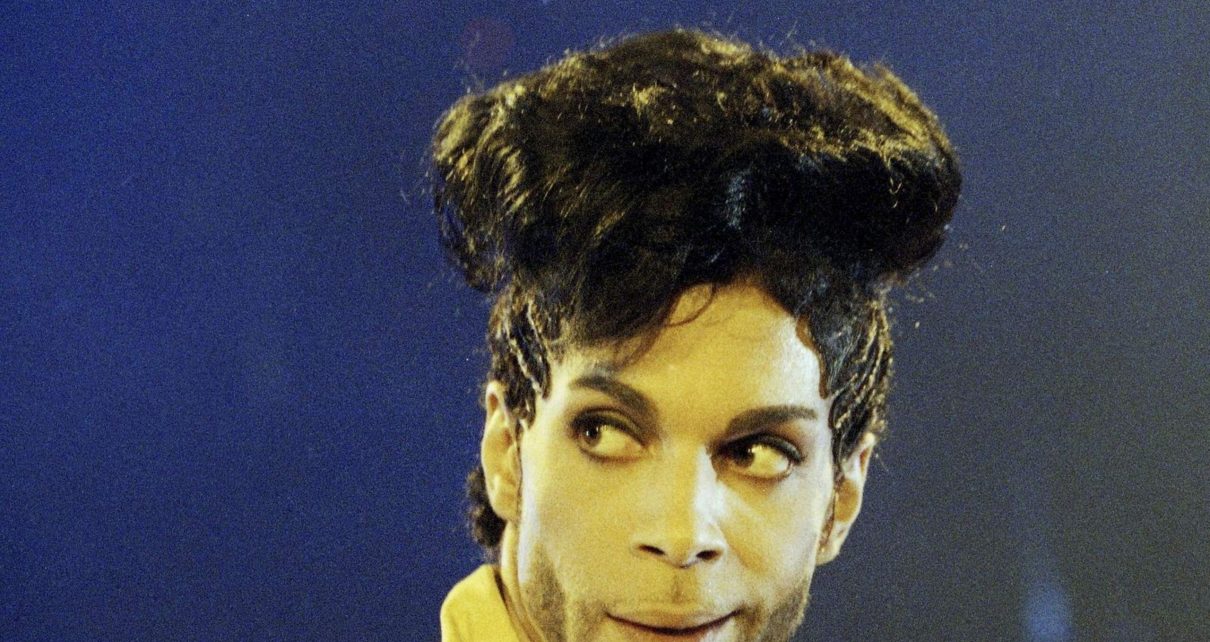

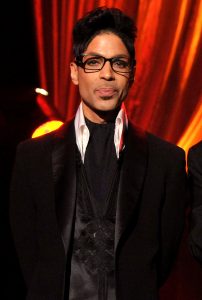

The late musician’s property, money and possessions were worth $80m more than administrator’s estimated, the IRS suggests

The estate of pop star Prince owes another $32.4 million (£23.7m) in taxes after his executors undervalued it by around 50%, US officials say.

The Internal Revenue Service (IRS) believes the singer-songwriter was worth $163.2 m (£119.3m) when he died, nearly double the $82.3m (£60.2m) valuation submitted by Comerica Bank & Trust, the estate’s administrator.

Documents filed in a US tax court show the discrepancy centres on Prince’s music publishing and recording interests.

Tax collectors are also demanding a $6.4m (£4.7m) fine, described as an “accuracy-related penalty”, citing a “substantial” undervaluation of assets, the documents show.

Estimates of Prince’s net worth have varied wildly from $100m (£73.1m) to $300m (£219.3m) since his death following a fentanyl overdose at the age of 57 in April 2016.

As the star did not leave a will, deciding what to do with his money has become one of the largest and most complicated probate court proceedings in the history of the US state of Minnesota.

Prince’s six sibling heirs have grown increasingly unhappy, particularly as the estate has doled out tens of millions of dollars to lawyers and consultants.

Comerica and its lawyers at Fredrikson & Byron in Minneapolis maintain their estate valuations are solid.

Comerica sued the IRS this summer in US Tax Court in Washington, DC, saying the agency’s calculations are riddled with errors.

“What we have here is a classic battle of the experts – the estate’s experts and the IRS’ experts,” said Dennis Patrick, an estate planning attorney at DeWitt LLP in Minneapolis who is not involved in the case.

Valuing a large estate, Mr Patrick added, “is way more of an art than a science”.

Comerica, a Dallas-based financial services giant, has asked the tax court to hold a trial.

That could lengthen the time needed to settle matters and generate more legal fees at the expense of Prince’s heirs, Mr Patrick said.