Negative sentiments continued on the Nigerian Stock Exchange (NSE) on Thursday with the market indices dropping further by 0.25 per cent, amid sell pressure on Tier 1 banks.

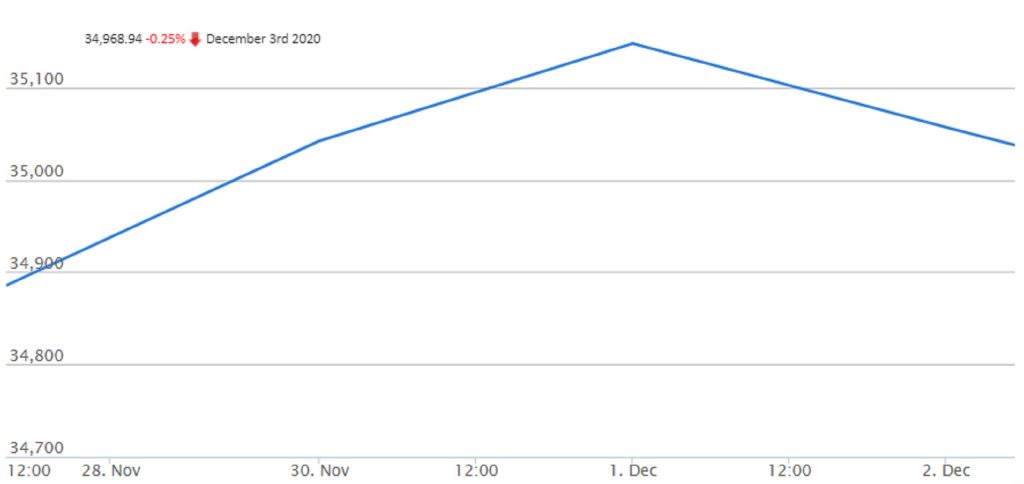

Specifically, the NSE All-Share Index dropped 87.88 points or 0.25 per cent to close at 34,968.94 compared with 35,056.82 achieved on Wednesday.

Accordingly, month-to-fate return declined to -0.2 per cent and year-to-date gain moderated to 30.3 per cent.

Similarly, the market capitalisation shed N46 billion or 0.25 per cent to close at N18.276 trillion from N18.322 trillion recorded on Wednesday.

The downtrend was also driven by price depreciation in medium and large capitalised stocks amongst which were: Guaranty Trust Bank, Flour Mills, Cadbury, United Bank for Africa and Zenith Bank.

Market sentiment remained negative with 25 losers in contrast with 13 gainers.

Unity Bank drove the losers’ chart in percentage terms by 9.86 per cent to close at 64k per share.

Chams followed with a decline of eight per cent to close at 23k, while Nigerian Aviation Handling Company declined by 6.81 per cent to close at N2.19 per share.

Consolidated Hallmark Insurance lost 6.67 per cent to close at 28k, while Ecobank Transnational shed 6.35 per cent to close at N5.90 per share.

On the other hand, Mutual Benefits Assurance dominated the gainers’ chart in percentage terms, gaining 9.52 per cent to close at 23k per share.

Royal Exchange followed with 9.09 per cent to close at 24k, while FTN Cocoa Processors rose by eight per cent to close at 27k per share.

Ardova went up by 7.69 per cent to close at N14, while Cutix appreciated by 5.56 per cent to close at N1.90 per share.

The total volume of trade decreased by 21.5 per cent as investors bought and sold 289.39 million shares valued at N7.35 billion achieved in 4,878 deals.

This was against 368.96 million shares worth N5.49 billion exchanged in 4,598 deals.

Transactions in the shares of UBA topped the activity chart with 34.45 million shares valued at N283.44 million.

Zenith Bank accounted for 31.20 million shares worth N743.58 million, while MTN Nigeria Communications traded 27.41 million shares valued at N4.38 billion.

Access Bank sold 22.96 million shares worth N196.04 million, while Mutual Benefits Assurance transacted 22.49 million shares worth N5.06 million. (NAN)