The Nigerian Stock Exchange (NSE) on Thursday triggered circuit breaker to guard against sharp market fluctuation as the All-Share Index (ASI) rises beyond five per cent threshold.

The NSE in a statement posted on its website said that a market-wide circuit breaker kicked in on Thursday, at 12:55p.m, when the NSE ASI rose beyond the set threshold of five per cent.

It said that the rise triggered a 30-minute trading halt of all stocks.

Circuit breakers are trading halts used by exchanges to guard against sharp fluctuations on the market.

The circuit breaker threshold is usually set by the Exchange from time to time.

This is the first time that the circuit breaker had kicked in since its introduction by NSE in 2016.

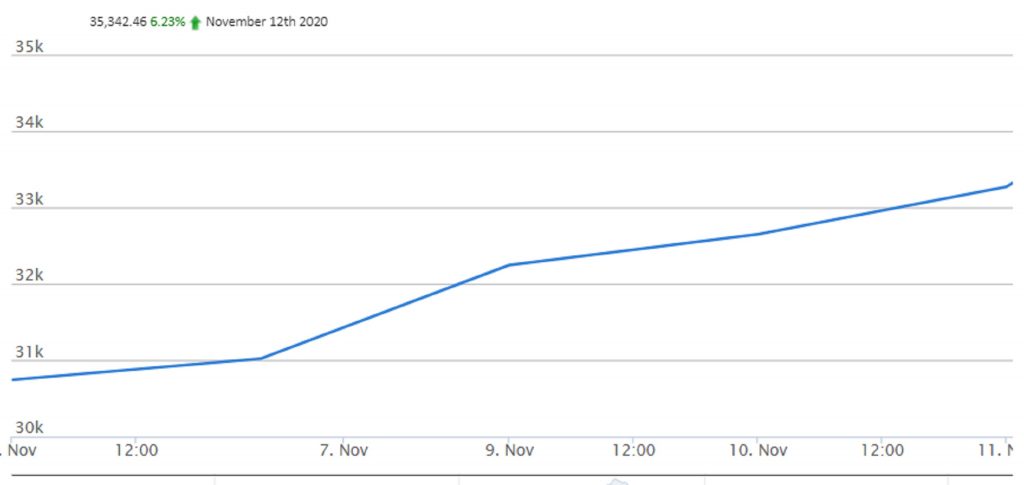

The exchange said that the circuit breaker protocol was triggered by the increase of the NSE ASI from 33,268.36 to 34,959.39, indicating a growth of 1,691.03 points or 5.08 per cent.

“The market reopened at exactly 1:25p.m. with a 10-minute intraday auction session, before resuming continuous trading till the close of the day at 2:30p.m.

“During the halt of trading, no order could be placed until trading resumed. However, existing orders could be withdrawn or canceled but could not be modified.

“Trading halts did not affect the clearing, settlement, and depository operations for matched trades, as these functioned as normal,” it said.

It added that all existing orders keyed in prior to the trading halt were re-activated and were matched upon resumption of trading.

Commenting on the issue, Uche Uwaleke, Professor of Capital Market, told the News Agency of Nigeria (NAN) that the action would stem market speculation.

“A circuit breaker, usually in form of a temporary trading halt, is conventionally used by an Exchange to stem panic selling and prevent stock market crash.

“It can also serve the purpose of stemming market speculation and cooling the market when a limit-up mechanism suggests that the market is getting over-heated.

“This is what has happened today when the Exchange got the market to cool off for a period of time before trading was resumed after the intraday price movement limit was exceeded,” he said.

Uwaleke, also President, Capital Market Academics of Nigeria, said that the development was a pointer to effective market regulation by the Exchange and commended it for the timely trigger.

“It’s important that bullish stock prices are justified by fundamentals otherwise a bubble sets in which can have grave consequences not only to the market but also the economy in general,” he added. (NAN)