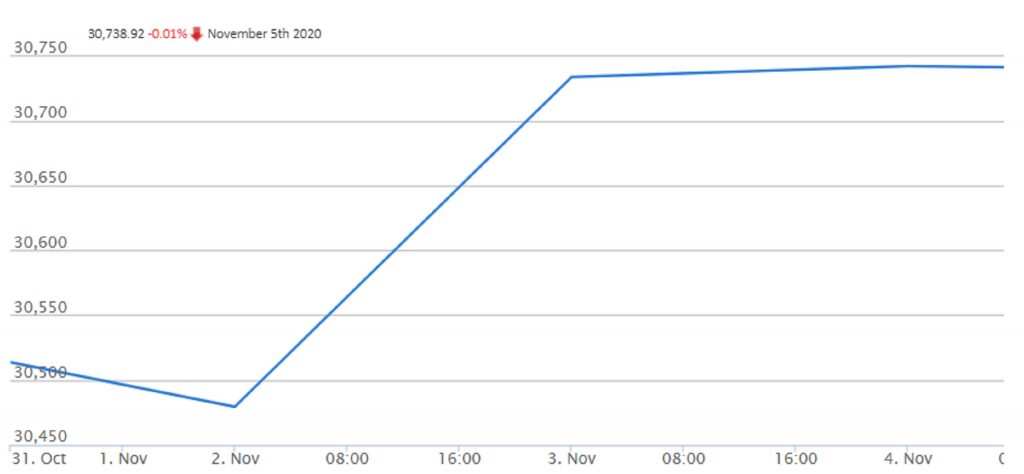

Trading on the Nigerian Stock Exchange on Thursday closed on a negative posture with a loss of 0.01 per cent.

Specifically, the All-Share Index declined by 0.01 per cent or 2.96 points to close at 30,738.92 compared with 30,741.88 recorded on Wednesday.

Similarly, the market capitalisation lost N6 billion to close at N16.062 trillion from N16.068 trillion achieved on Wednesday.

The downturn was impacted by losses recorded in medium and large capitalised stocks, amongst which are; Flour Mills of Nigeria, International Breweries, Fidson Healthcare, Union Bank of Nigeria and GlaxoSmithKline Consumer.

Transcorp dominated the gainers’ chart in percentage terms, gaining 9.86 per cent to close at 78k per share.

Learn Africa followed with 9.52 per cent to close at N1.15, while Africa Prudential rose by 9.35 per cent to close at N6.20 per share.

Livestock Feeds inched higher by 8.99 per cent to close at 97k, while Mutual Benefits Assurance appreciated by five per cent to close at 21k per share.

Conversely, Linkage Assurance led the losers’ chart in percentage terms, losing by 8.89 per cent to close at 41k per share.

Associated Bus Company followed with 8.82 per cent to close at 31k, while Condolidated Hallmark lost 8.11 per cent to close at 34k per share.

Union Diagnostic depreciated by 7.41 per cent to close at 25k, while Fidson Healthcare declined by 6.82 per cent to close at N4.10 per share.

Transactions in the shares of FBN Holdings topped the activity chart with 61.49 million shares valued at N390.60 million.

BUA Cement followed with 50.28 million shares worth N2.28 billion, while Access Bank traded 46.24 million shares valued at N373.69 million.

Transcorp sold 38.54 million shares worth N29.58 million, while Zenith Bank sold 35.99 million shares valued at N787.37 million.

In all, the total volume of shares traded appreciated by 50.16 per cent with an exchange of 430.12 million shares worth N6.62 billion traded in 4,319 deals.

This was against a turnover of 286.45 million shares valued at N3.09 billion exchanged in 2,889 deals on Wednesday. (NAN)