The Nigerian equities market resumed November trading with a loss of 0.17 per cent, halting the six-day bullish run on the back of profit taking.

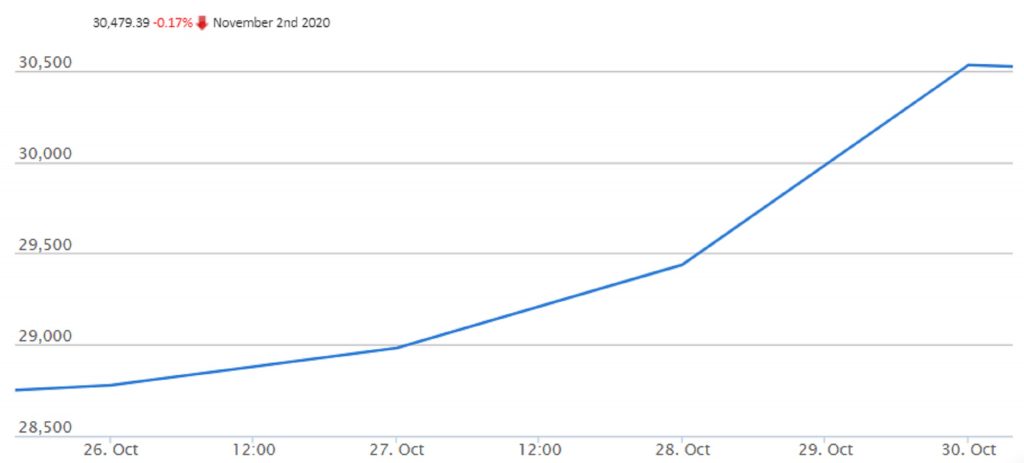

The All-Share Index decreased by 51.30 points or 0.17 per cent to close at 30,479.39 compared with 30,530.69 achieved on Friday.

Also, the market capitalisation which opened at N15.957 trillion lost N26 billion or 0.17 per cent to close at N15.931trillion.

The downtrend was impacted by losses recorded in large and medium capitalised stocks, amongst which are; Mobil Nigeria, Ecobank Transnational, Julius Berger, C &I Leasing and International Breweries.

For trading activities this week, analysts at United Capital Plc said, “We expect the earnings to continue to sway the direction of the market, coupled with the low yield environment as we await the Tier one banks results.”

Analysts at Afrinvest Ltd said, “This week, we expect to see slight profit-taking at the start of the week.”

Market breadth was negative with 26 losers compared with 22 gainers.

C &I Leasing led the losers’ chart in percentage terms, dropping by 10 per cent to close at N3.96 per share.

FCMB Group followed with 9.90 per cent to close at N2.82, while ETI shed 8.85 per cent to close at N5.15 per share.

Oando dipped 6.55 per cent to close at N2.57, while International Breweries lost 5.02 per cent to close at N7 per share.

Conversely, Livestock Feeds dominated the gainers’ chart in percentage terms, gaining 9.88 per cent to close at 89k per share.

Dangote Sugar Refinery followed with 9.78 per cent to close at N15.15, while NPF Microfinance Bank rose by 9.68 per cent to close at N1.70 per share.

Regency Alliance improved by 9.09 per cent to close at 24k, while Royal Exchange appreciated by 8.70 per cent to close at 25k per share.

Also, the total volume of shares traded decreased by 53.41 per cent as investors bought and sold 376.65 million shares worth N3.80 billion in 6,050 deals.

This was against a turnover of 807.81 million shares valued at N10.50 billion transacted in 8,113 deals on Friday.

Transactions in the shares of Fidelity Bank topped the activity chart with 49.89 million shares worth N122.16 million.

Zenith Bank followed with 47.04 million shares valued at N1.03 billion, while Dangote Sugar traded 30.94 million shares worth N465.16 million.

Sterling Bank sold 30.23 million shares valued at N57.62 million, while United Bank for Africa transacted 29.71 million shares worth N225.96 million. (NAN)